Technical merchants make their dwelling on the popularity of particular inventory chart patterns. The extra distinguished and pronounced the sample, the better it’s to acknowledge throughout formation. Few are as simply recognizable and provides as a lot lead time as a cup and deal with sample.

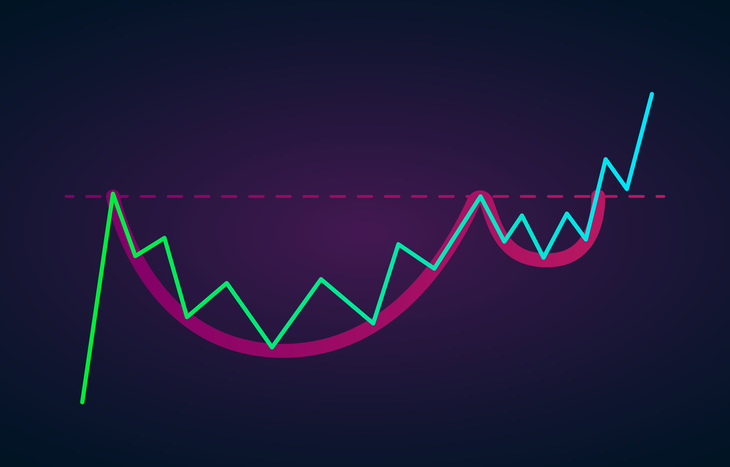

A cup and deal with sample derives its identify from the form it takes on the inventory chart. It’s a U-shaped sample created by a decline in inventory worth that bottoms-out earlier than buying and selling again up, ending in a interval of sideways buying and selling. Because the identify implies, a cup and deal with sample seems like a cup with a deal with. It’s a sample that always takes tens of weeks to kind.

Right here’s acknowledge the formation of a cup and deal with sample, what it signifies and commerce one with confidence.

What’s Occurring Behind the Scenes?

The cup and deal with sample is a bullish continuation sample. Meaning it’ll finally culminate in an upward-trending breakout. It’s vital for merchants to know the psychology and market motion that contributes to its formation, and there are a number of phases to think about.

- The sample begins with an upward pattern in inventory worth that results in a peak. This implies bullish sentiment in regards to the firm’s efficiency.

- After peaking, the value of the inventory will steadily commerce downward after encountering promoting stress. Bears have taken over, and can drive the value down as a lot as a 3rd. Throughout this time, buying and selling quantity will shrink.

- After the preliminary decline, the inventory will discover help as bears come again in to capitalize on the cheaper price. Nonetheless, bears and bulls will battle at this degree, inflicting sideways motion for a time period (a number of weeks).

- As bulls retake management, the value begins to commerce upward once more till it matches its earlier excessive. Search for elevated quantity at this stage.

- Matching the earlier peak, the inventory’s quantity will taper off. The share worth will set up a brand new degree of help that trades sideways for a brief time period (lower than a month).

Figuring out help and resistance ranges is vital in assessing a possible cup and deal with sample, as is monitoring quantity. Merchants have to look past the telltale look of a cup and deal with on the inventory chart and quantify the bullish and bearish sentiments that drive this sample’s formation.

Commerce a Cup and Deal with Sample

The cup and handle pattern is one of the easiest to trade. One of many easiest methods is to attend for the cup to kind and use its worth knowledge to set entry, exit and stop-loss factors for the deal with.

For example, you may place a cease purchase order simply above the higher pattern line of the deal with to capitalize as quickly as the value breakout begins. A technique in additional unsure patterns is to position a restrict order just under the sample’s breakout degree, which may set off execution within the occasion of retracement.

In relation to taking income, merchants can use the better sample to tell exit positions. Usually, that is merely a mirror of the gap between the low level of the cup to the breakout degree. For example, if a inventory trades for $25 on the backside of a cup and the deal with breakout happens at $35, merchants ought to set a worth goal of $45. It’s sensible to additionally set up stop-loss buffers inside a tolerance that fits your threat degree.

Components to Take into account in Assessing Sample Power

There are completely different variables that may dictate the form or energy of the cup and deal with sample. Buyers ought to take note of the next measures of relative sample energy:

- Quantity. Quantity is a key indicator of sample energy on each side of the cup formation. Search for gradual pullback in quantity in the course of the cup formation and a common ramp up because the inventory worth rises.

- Size. Sometimes, a wholesome cup and deal with sample has a distinctly rounded backside. Keep away from V-shaped rebounds, as they point out reactionary shopping for that might nullify the formation of the deal with and subsequent breakout.

- Depth. The perfect cup and deal with sample sees a pullback of about one third from latest highs. The extra vital the dip, the stronger the restoration effort must be. The identical goes for any pullback on worth in the course of the deal with formation.

It doesn’t matter what the sample finally seems like on a chart, the cup and deal with is a traditional continuation sample. Meaning the deal with will normally get away in vital positive factors, to mark continued bullish sentiment within the inventory.

Drawbacks of the Cup and Deal with Sample

Whereas simple to establish and commerce, there are some key drawbacks to cup and deal with patterns. The largest is the time that they take to develop. Most will kind between a month and a yr, which may make it troublesome to identify for merchants a narrower scope of inventory behaviors. Consequently, many merchants see a cup and deal with sample too late.

The opposite chief criticism of this sample is the prospect for false indicators. Shallow cups or retracement that fails to get again to the earlier resistance degree can see the sample crumble when it comes time to kind the deal with. That is why it’s so vital to concentrate to quantity when assessing the sample energy.

Look ahead to Cup and Deal with Patterns

Technical merchants inventory costs over an extended time interval could have no bother recognizing a cup and deal with sample. Earlier than leaping in, take the time to have a look at the amount behind the buying and selling motion and set up the energy of the sample. Setting entry and exit targets is the simple half, supplied the cup and deal with sample culminates in a bullish continuation such as you count on it to.